An average of 11,000 Americans per day will turn 65 this year – the largest wave in U.S. history. This “silver tsunami” reflects a record number of people reaching retirement age, a trend predicted to continue for a while – it’ll be another six years before the annual number of Americans turning 65 dips back below four million.

A record-breaking populace, in turn, means an unprecedented opportunity for your financial practice to grow its client base: an ocean of Americans looking for guidance on how to retire successfully. But how will you expand your reach to capture this surge of prospects approaching “Peak 65”?

Traditional vs. Emerging Media

Around 370 B.C., Socrates argued in Plato’s Phaedrus that writing was inferior to the original art of spoken word. In 2019, Steven Spielberg tried to block streaming services like Netflix, Hulu, and Amazon from competing in the Oscars if their productions didn’t first run in movie theaters. The tension between traditional media and emerging platforms has been in public discourse for centuries. Emerging media typically refers to the smartphone and streaming set (for financial advisor marketing, that means digital and podcasting), while traditional media refers to cable and satellite (also known as terrestrial) television and radio.

There’s always an appeal in embracing emerging media trends and keeping up with the newest developments. With common phrases like, “cut the cord,” it’s easy to believe that traditional media is a lost relic. However, the data tells a very different story, particularly for financial advisors’ target demographic!

The Reach of Traditional Media

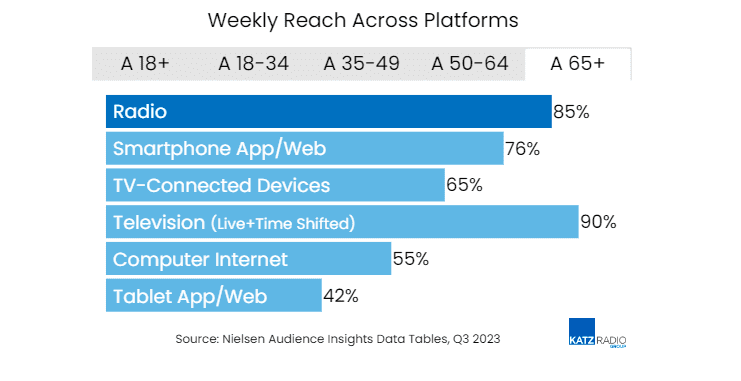

Despite the notion that today’s media environment is dominated by the Internet, the numbers speak for themselves. Television and radio are the primary sources retirees prefer to consume their news and entertainment. Bottom line, traditional media is still the most effective and impactful way to get in front of more people and foster a prospect’s trust before they ever set foot in your office.

We’re definitely not suggesting that you ignore new platforms! A healthy media and marketing strategy embraces classic methods and new technologies. Our point is you can’t leave what’s tried-and-true in the dust when a shiny new object catches your eye. Trust in traditional media figures is inherent to the form in a way emerging media hasn’t yet accomplished. Television is Walter Cronkite; TikTok is… who, exactly? If you want the growth of your financial practice to pace with the historic increase of retirement-age Americans, it’s imperative to include traditional media.

Bolstering Your Image Through Media

Let’s talk more about establishing trust with the target audience you’re trying to reach as a financial advisor. Transitioning into retirement can be nerve-racking for most people, especially when market volatility is just a hair-trigger away. People are looking for someone they can trust to help navigate what should be the most enjoyable chapter of their lives.

It’s important to not only consider what you’re saying through media, but how. Storytelling isn’t just a powerful tool at seminars and your conference table. When storytelling is paired with broadcast-quality production, your brand becomes more credible.

Working with an experienced team who understand leveraging both traditional and emerging media platforms ensures that you will look and sound your best. As pros, they know the tips and tricks of the industry – creating story-driven scripts and outlines tailored to your market, smart media buying so your content reaches the right audience, and how to best speak clearly, concisely, and confidently in your own voice. High-net-worth clients don’t typically trust their life’s savings to financial advisors who only use their iPhones to record video ramblings in the front seat of their car.

Radio and TV get you halfway up the mountain with prospective clients. Well-produced and well-placed media can make you a relatable human, not just a cold salesperson. The more folks hear your story and see your face, the sooner they’ll get to know, like, and trust you before they even walk through your office door. Or in cold salesperson speak, media shortens the sales process, allowing you to close business faster.

Real-Life Examples

Are you already a successful financial advisor and think media can’t do much more to grow your bottom line? We hear you. Before Greg A. partnered with Impact, he was already producing $115 million in FIA premium. Hard to imagine being more profitable, but he knew his practice wasn’t reaching its full potential. Greg A. is a CEO who knows how to dream big. In less than two years of producing shows with Impact’s Radio and Television teams, Greg’s jumped up to $177.5 million in FIA premium and serves eight major media markets.

The power of media is undeniable. It can revolutionize your financial practice and change your life.